The Anthony Robins Guide To Short Term Online Loans

Read our latest article on the method to qualify for a private loan and other standards you’ll need to satisfy. Bad-credit online lender, but your rate could be on the high finish of the lender’s APR range. Unsecured loans are often payday loans or different short-term loans with low loan amounts. Review your credit report to seek out any quick fixes that could bring your score up. The lenders still contemplate your financial history in determining the loan phrases, but it still helps those that can not provide collateral with the means to borrow money.

Now10K can be a solid option for debtors with poor credit. Since MoneyMutual operates online, it has made lending much simpler since you will solely require both a laptop or a smartphone with access to a good internet connection. Predatory payday lenders cost triple-digit interest rates and exorbitant fees to borrowers who need short-term cash. Two weeks ago, Microsoft mentioned it deliberate to bake an app referred to as Zip instantly into Edge. This way, your auto loan won’t eat up an enormous chunk of your monthly budget.

Now10K can be a solid option for debtors with poor credit. Since MoneyMutual operates online, it has made lending much simpler since you will solely require both a laptop or a smartphone with access to a good internet connection. Predatory payday lenders cost triple-digit interest rates and exorbitant fees to borrowers who need short-term cash. Two weeks ago, Microsoft mentioned it deliberate to bake an app referred to as Zip instantly into Edge. This way, your auto loan won’t eat up an enormous chunk of your monthly budget.

Please go to our Important Updates page for the latest information on cost choices and sources. When accumulating funds owed, small-dollar lenders can be required to offer advance notice to borrowers before trying to debit payment from their depository checking, financial savings, or pay as you go accounts. These payday loans might help these with bad credit construct themselves up to a greater credit rating if used responsibly. Another thing you should know about lending money from MoneyMutual is the interest rates range.

After two consecutive makes an attempt to collect fee, a model new authorization could be required from the borrower before the lender might make one other try to gather payment. In addition to the size of time the money will needed, the size of the monthly payments and price of the loan are concerns. So, you don’t have any causes to fret about your personal information being uncovered when utilizing the providers of this platform. This implies that you won’t be tight on funds and nonetheless be succesful of save a part of your earnings for emergency expenses.

Borrowers who can’t afford to repay inside 2 weeks are sometimes compelled to roll over their loans and pay further fees. Their web site design is a piece of cake, that means you wouldn’t have to waste much of your valuable time finding your way. These are small cash advances which would possibly be quick and straightforward to get while not having credit checks or collateral. Just fill out a quick utility, and get a credit decision in seconds.

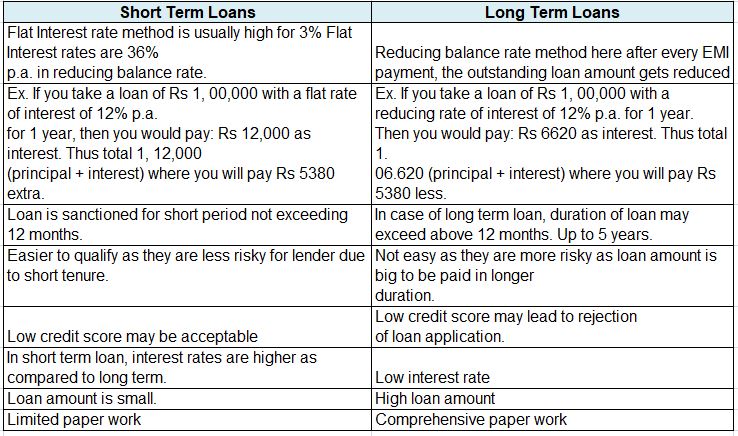

Shop with PayPal Credit’s digital, reusable credit line anywhere PayPal is accepted and revel in 6 months particular financing on purchases of $99.00+. Before making use of for a short-term loan, debtors ought to first determine whether or not a short-term loan is an effective match. Short-term business loans are sometimes used to assist small enterprise homeowners cover temporary cash circulate gaps. The advantages of an extended loan interval include lower interest rates and smaller month-to-month funds.

A lender would still be ready to make loans as a lot as $500 with out underwriting if the borrower doesn’t have any other outstanding short-term loans or loans with balloon funds. Because short term loans-term loans are usually repaid inside three to 18 months, lenders foresee much less of a threat of default and are extra likely to take on borrowers they see as riskier. While traditional financial institution loans and even another forms of various lending require a strong credit score, best short Term payday Loans-term loans can be an option for those with a credit score as low as 550.

For lenders preferring to not meet the full payment take a look at, the rule contains an alternative compliance possibility that stipulates required loan options. From planning a big occasion to facing an surprising expense to consolidating debt, see all the ways to make use of a personal loan. This has led many individuals into resorting to short term payday loans online . An installment loan is basically a payday loan with a fixed number of rollovers, each one carrying a brand new spherical of charges.

In case your employer permits 401(ok) loans — not all do — you usually can borrow as a lot as half your account stability, as much as $50,000, and you’ve got 5 years to repay it. The format of applying for these loans is easy the borrower has to go through the terms and conditions referred on website after which he shall be required to fill an software requesting for the quantity of mortgage required by him.

Leave a Reply